{{item.title}}

{{item.text}}

{{item.text}}

PwC's Economics experts have the in-depth knowledge and skills necessary to develop market analysis and forecasts, impact assessments (whether economic, social and/or environmental), cost-benefit analysis, or any other support related to economic topics, intended to support informed decision-making.

Our team comprises specialist economists who are skilled in developing targeted approaches and methods to answer your questions. We tailor our services to your individual needs, offering theoretical and empirical studies and expert opinions based on pragmatic approaches and scientifically recognised methods, which can be stand-alone or contribute to broader studies that need the contribution of economic knowledge, generating insights relevant to support governments, regulatory bodies, associations and companies in their strategic decisions. We do not use a single methodology, but we select the one that we consider most appropriate for each particular case, based on the characteristics of the available data and project objectives.

In addition, our global PwC network provides access to economics experts in multiple markets, with more than 200 international Economics’ colleagues in the UK, Australia, Canada, France, India, the Netherlands, Spain, the US, among others.

PwC has a long record of applying economic tools in new and innovative ways, providing evidence-based insights to support strategic and business planning, by combining economic expertise with PwC’s sector insight.

Integrating sustainability, in all its angles, into the activities of companies, contributes to the creation of long-term value, not only for their shareholders (internal perspective), but also for society and their stakeholders (internal perspective).

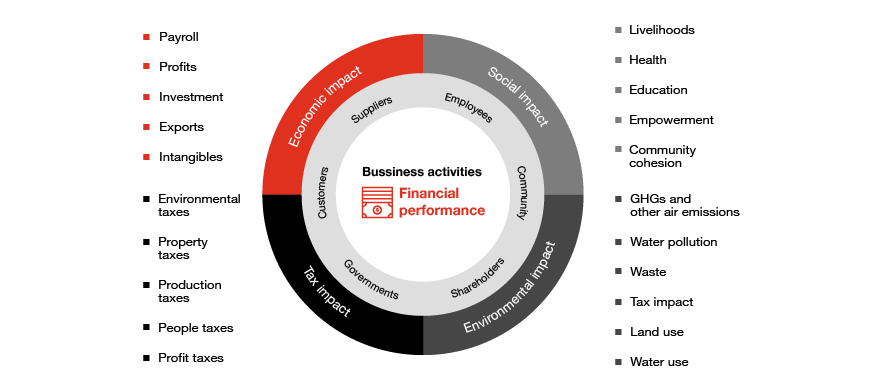

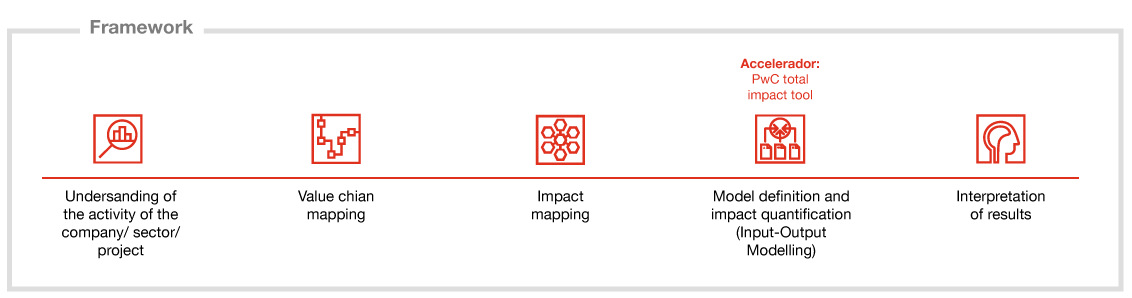

PwC supports its clients in identifying and quantifying which are the axes of value creation (or destruction) associated with their activity, that is, we help understand the impacts arising from strategic decisions (ex-ante or ex-post), whether of a project, policy or sector, not only the direct financial effects, but also the economic, fsocial and environmental impacts throughout its value chain.

It refers to a company´s contribution to the economy. It incoporates the consequances of the direct, indirect and induced impacts of several indicators: gross value added, profits, wages, investments, taxes and trade balance.

It incorporates the effects of the company´s activities on society, such as: health, education community support.

It refers to a company´s impact on society as a result of greenhouse gas (GHG) emissions, atmospheric emissions, land use, water pollution and waste production.

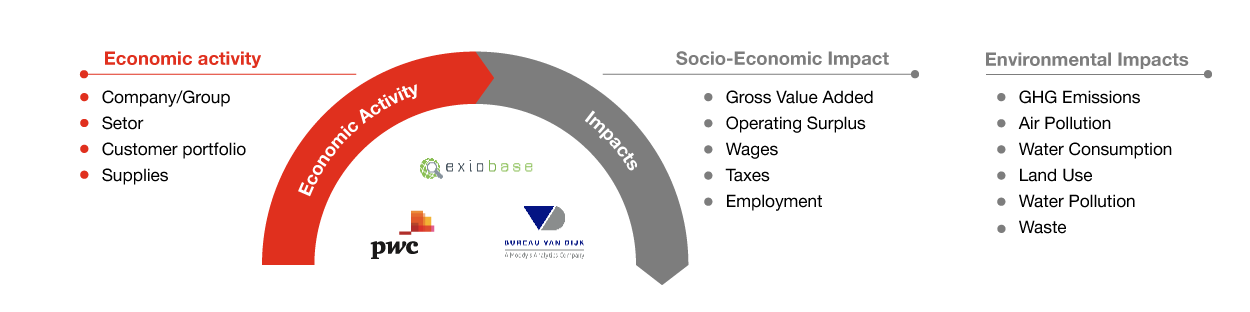

In addition, we have developed the PwC Total Impact Tool, which allows us to quickly estimate the environmental and socio-economic footprint of a company/sector, based on its level of activity and its supply structure.

At PwC, we believe that to make effective decisions with tangible impact, programs must be well supported since its inception and outcomes must be monitored and evaluated.

Quantifying and explaining the effects of interventions (ongoing or completed project, programme or policy, its design, implementation and results) is essential for policy makers to make informed decisions. Together with the client and other actors of funding practice we develop and discuss the best approach to assess and monitor interventions’ results, through a methodology mix comprised of quantitative and qualitative approaches, resulting in the provision of specific recommendations for action.

1. Diagnostic reviews: We conduct diagnostic reviews to understand the current state, opportunities, and challenges of specific markets, sectors, trends, and policy areas, and the implications of these.

2. Visioning, planning and strategy: We develop overall visions, plans and strategies for growth and sustainable development. We also produce forecasts, trend analysis and scenario analysis to provide foresight on key policy areas and the implications of these.

3. Project appraisal and prioritisation: We conduct ex-ante assessments of individual, or portfolios of, policies, programs, and investments, to assess trade-offs and guide prioritisation. We believe that to optimise investment and project selection, decisions should be based on a balance of long-term strategies and short-term imperatives.

4. Monitoring: Through program monitoring, we analyse the evolution of a program and its information, compare the actual results with the planned ones, aiming to assess how well the intervention is being implemented. This exercise is an opportunity to take action, making changes to ensure the goals are met.

5. Evaluation: We conduct interim and retrospective assessments of individual, or portfolios of, policies, programs and investments, to evalutate its efficiency, effectiveness, impact, relevance and/or sustainability.

{{item.text}}

{{item.text}}